prince william county real estate tax relief

The system will verbally provide you with a receipt number for you to write down. Ad At-a-glance see real reviews by real people for Tax Relief companies.

Job Opportunities Prince William County

Let our ranking algorithm find you the best Tax Relief company in your area.

. It was founded in 2000 and is a member of the American Fair Credit Council the US Chamber of Commerce and is accredited with the International Association of Professional Debt Arbitrators. Income 0-28000 qualifies for 100 tax relief. Whether you are already a resident or just considering moving to Prince William County to live or invest in real estate estimate local property tax rates and learn how real estate tax works.

So for example on a 400000 home sale the tax would be 1000. To qualify an applicant must. Real Estate Tax Exemptions are available for certain elderly and disabled persons.

Ad Dont Waste Money and Time Fighting the IRS Alone - Choose the Best Tax Relief Services. Does the Congestion Relief Fee. Tax Relief for the Elderly and Disabled.

It was founded in 2000 and has since become a member of the American Fair Credit Council the US Chamber of Commerce and has been accredited by the International Association of Professional Debt Arbitrators. The Office of the Commissioner of the Revenue is responsible for administering a program for tax relief on real estate and mobile homes for eligible elderly and disabled residents of Prince George County. The Tax Relief for the Elderly and Disabled is authorized under the Code of Virginia 581-3210.

Mobile home applicants must file by February 15th. Your total household income is less than 45000. The board voted unanimously to defer payments for the first half of annual real estate taxes originally due today July 15 -- until Oct.

Press 2 to pay Real Estate Tax. Ad 2022 Latest Homeowners Relief Program. Income 28001-45000 qualifies for 50 tax relief.

Affidavit or certification must be made between January 1 and March 1 for the taxable year. The Board of County Supervisors reviewed. The Finance Department of Prince William County administers a real estate tax relief program for older adults age 65 and older as well as adults with total and permanent disability who meet the income and asset guidelines.

About the Company Prince William County Va Real Estate Tax Relief CuraDebt is an organization that deals with debt relief in Hollywood Florida. King William County Phone. Make a Quick Payment.

Dial 1-888-2PAY TAX 1-888-272-9829. Prince William County has one of the highest median property taxes in the United States and is ranked 120th of the 3143 counties in order of. CuraDebt is a debt relief company from Hollywood Florida.

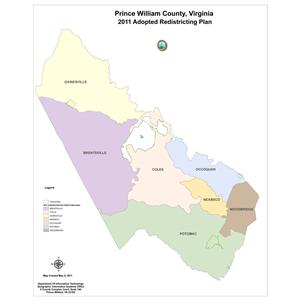

It was established in 2000 and has since become a part of the American Fair Credit Council the US Chamber of Commerce and has been accredited through the International Association of Professional Debt Arbitrators. This legislation was done by passing a ruling to increase the Grantor Tax in the form of a Congestion Relief Fee. All real property in Prince William County except public service properties operating railroads interstate pipelines and public utilities is assessed annually by the Real Estate Assessments Office.

Your assets excluding your home do not exceed 120000. Real Estate Assessments Office 703 792-6780 4379 Ridgewood Center Drive 203 Prince William VA 22192. Check If You Qualify For 3708 StimuIus Check.

The median property tax in Prince William County Virginia is 3402 per year for a home worth the median value of 377700. Elderly Citizens and Disabled Persons who meet certain criteria may be granted relief from all or part of their real estate taxes personal property tax on one vehicle the vehicle registrationlicense fee and the solid waste fee. A convenience fee is added to payments by credit or debit card.

For additional information on Real Estate Tax Relief please contact. Enter the Account Number listed on the billing statement. How is the Congestion Relief Fee Calculated.

Contact the County that you moved from and then call Prince William County at 703-792-6710. Press 1 to pay Personal Property Tax. You will need to create an account or login.

CuraDebt is a debt relief company from Hollywood Florida. About the Company Prince William County Real Estate Tax Relief CuraDebt is an organization that deals with debt relief in Hollywood Florida. About the Company Prince William County Property Tax Relief For Seniors CuraDebt is an organization that deals with debt relief in Hollywood Florida.

Prince William County collects on average 09 of a propertys assessed fair market value as property tax. Income 28001 - 45000- 50 tax relief. Learn all about Prince William County real estate tax.

Payment by e-check is a free service. It was founded in 2000 and has been an active participant in the American Fair Credit Council the US Chamber of Commerce and has been accredited through the International Association of Professional Debt Arbitrators. Prince William County residents will face higher property taxes over the next 12 months with the average homeowner paying 172 more in Real Estate taxes.

It was established in 2000 and has since become an active member of the American Fair Credit Council the US Chamber of Commerce and has been accredited with the International Association of Professional Debt Arbitrators. All information as to age gross income and net worth must be for the immediately preceding tax year. Real estate applicants must file no later than August 1st.

About the Company Property Tax Relief For Seniors In Prince William County Va. Prince William property owners will get a three-month extension on their real estate tax bills as a result of action the board of county supervisors took Tuesday. Property tax information for Prince William County Virginia including average Prince William County property tax rates and a property tax calculator.

About the Company Prince William County 2021 Tax Relief Application. Prince William County Code Chapter 26 Article V Eligibility criteria may change from year to year. Net combined financial worth excluding the value of the dwelling and five 5 contiguous acres of 120000 or less.

Homeowners Relief Program is Giving 3708 Back to HomeownerCheck Your Eligibility Today. Enter jurisdiction code 1036. All you need is your tax account number and your checkbook or credit card.

Enter your payment card information. Pittsylvania County businesses can now apply for small business assistance grants to receive as much as 15000 to help with rentmortgage relief and retooling to allow a better response to. Report changes for individual accounts.

Compare 2022s 10 Best Tax Relief Companies. The dwelling for which exemption is sought must be owned by and occupied as the sole dwelling of the applicant. Contact each County within 60 days of moving to avoid continued assessment in the County you are no longer living in and to be assessed accordingly by Prince William County.

Report a Change of Address. The fee is calculated at 025 per 100 of the sale price or fair market value whichever is higher.

Where Residents Pay More In Taxes In Northern Va Wtop News

Corscale Kicks Off 130 Acre Data Center Campus In Prince William County Virginia

Prince William County Budget Set For Approval Residents Can Expect To See Tax Bills Tick Up Wtop News

Data Center Opportunity Zone Presented By Prince William County Va Department Of Economic Development Date May 20 Ppt Download

Data Center Opportunity Zone Presented By Prince William County Va Department Of Economic Development Date May 20 Ppt Download

The Rural Area In Prince William County

Pin On Prince William County Virginia

Prince William County Partners With Human Services Alliance To Award More Than 6 Million For Covid 19 Recovery

Prince William County Budget Set For Approval Residents Can Expect To See Tax Bills Tick Up Wtop News

Prince William Wants To Hike Property Taxes Introduces Meals Tax

Acting County Executive Proposes The Fiscal Year 2023 Budget Prince William Living

Prince William Co Residents Decry Proposed Hike In Tax Bills Wtop News

Personal Property Taxes For Prince William Residents Due October 5

Northern Virginia Residential Property Tax Rates And Due Dates Smart Settlements

Prince William Officials Propose Further Cut In Tax Rate Reduction In Vehicle Assessments Headlines Insidenova Com